71% of Americans Have Noticed Shrinkflation — Here Are the Products and Categories That Shrunk the Most

If your grocery bags feel lighter or your trips to the store are becoming more frequent, you’re not alone. Some companies are reducing the size or quantity of their products rather than raising prices, leaving consumers shortchanged.

According to a LendingTree analysis of nearly 100 products, a third have shrunk. We’ll look at which products have decreased in size the most and offer tips on adapting your budget amid more frequent shrinkflation.

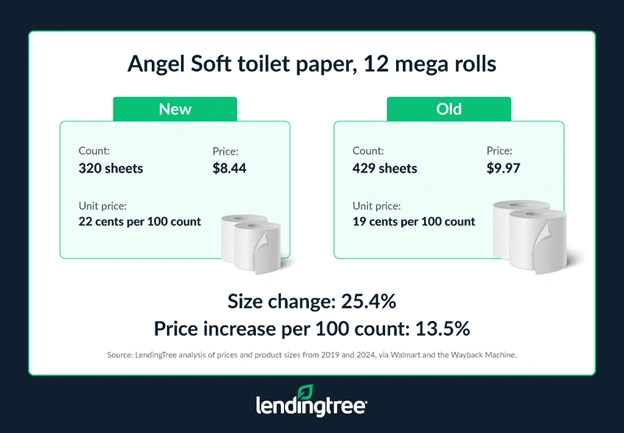

- A third of the 98 products LendingTree researchers analyzed have shrunk. Household paper products — toilet paper and paper towels — saw the highest rate of change via fewer sheets per roll. 12 of 20 (or 60.0%) household products reduced their sheet count, with 12 mega rolls of Angel Soft toilet paper decreasing the most (25.4%) in size from 429 to 320 sheets a roll.

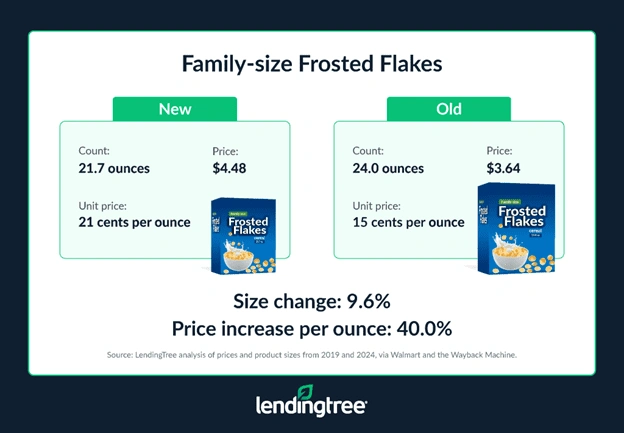

- Seven of the 16 (or 43.8%) breakfast items analyzed have been downsized since 2019 or 2020. Family-size Frosted Flakes dropped 9.6% from 24.0 ounces to 21.7, leading to a 40.0% price increase per ounce. Of the 13 candy items, five (38.5%) changed size. Meanwhile, six of 22 (27.3%) snacks analyzed underwent size reductions.

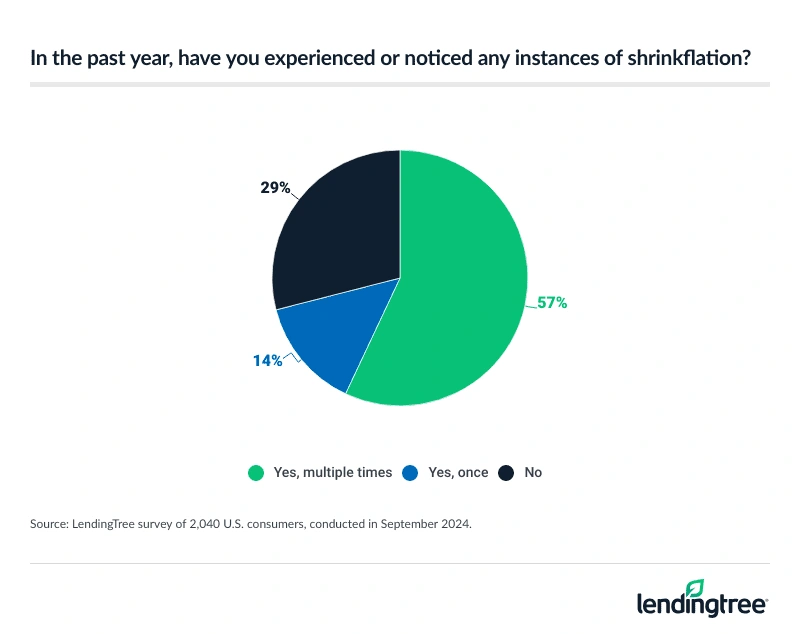

- 71% of Americans report experiencing or noticing at least one incident of shrinkflation in the past year. 57% of Americans say they’ve experienced or noticed multiple incidents of shrinkflation in the past year. Baby boomers (70%) are much more likely to report noticing multiple instances of shrinkflation in the past year than Gen Zers (48%) and millennials (54%). 87% of Americans who’ve noticed shrinkflation agree it’s becoming more common.

- Americans feeling misled by shrinkflation boycott offenders. 82% who’ve noticed shrinkflation say they feel deceived when they see incidents of it, and 66% say they’ve stopped buying products because of it. Gen Zers (80%) are most likely to say they stopped purchasing products because of shrinkflation.

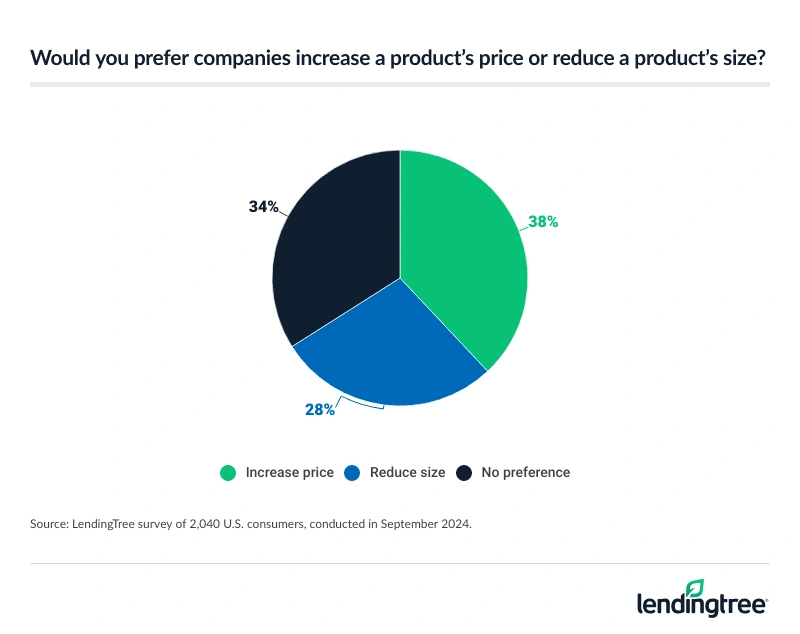

- Consumers don’t just look at prices, and they prefer price bumps over shrinking products. 89% of Americans always or sometimes compare brands’ product sizes or quantities when shopping. Many Americans would prefer that companies raise prices (38%) rather than reduce sizes (28%).

You’re not imagining it — products are shrinking

Across the nearly 100 products we analyzed, a third have shrunk. Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says that’s a big deal.

“People are already frustrated that things cost more,” he says. “Shrinkflation just adds insult to injury. It all adds up to a lot of Americans feeling squeezed every month to afford the basic things they can’t do without.”

Household paper products saw the highest rate of change. In fact, 12 of 20 (or 60.0%) household products reduced their sheet count over the analyzed period. Twelve mega rolls of Angel Soft toilet paper decreased significantly, shrinking from 429 sheets a roll in 2019 to 320 sheets in 2024. That’s a 25.4% reduction in size — the highest across the household products analyzed. (Another Angel Soft product, 18 mega rolls, was next at 24.7%).

While the cost of 12 Angel Soft mega rolls has dipped from $9.97 to $8.44, its price per 100 count increased from 19 cents to 22 cents, meaning consumers are paying 13.5% more per 100 sheets.

Note: While shrinkflation means reducing a product’s size without increasing the price, our product analysis explores size reductions and price increases separately. Just two products we analyzed experienced a price decrease between 2019 or 2020 and 2024.

Beyond Angel Soft, Bounty Select-A-Size triple roll paper towels saw the next biggest decrease in size, shrinking 18.2% from 165 sheets a roll to 135. Mega rolls of Quilted Northern Ultra Plush toilet paper rounded out the top four, with the number of sheets shrinking 17.2% a roll from 308 to 255.

Notably, one product that shrunk also increased its price about the same as a product that didn’t shrink. Twelve mega rolls of Cottonelle Ultra Comfort toilet paper decreased from 284 sheets a roll to 244. Prices also rose by 21.1% per 100 count — the same per-100-count price increase of a roll in a Scott 1000 toilet paper 12-pack, despite that product not shrinking in size.

Shrinking is one thing, but price hikes are another. While 24 mega rolls of Charmin Ultra Strong shrank from 286 sheets a roll to 242, prices jumped 31.4.% per 100 count from 35 cents to 46 cents. And while six double rolls of Sparkle Pick-A-Size paper towels minimally shrank, prices spiked 23.3% per 100 count from 89 cents to $1.10.

Full rankings: Household paper products that shrunk the most/least

| Product | Old # of sheets | New # of sheets | Old cost | New cost | Old price per 100 count | New price per 100 count | Price difference per 100 count (%) | Size change |

|---|---|---|---|---|---|---|---|---|

| Angel Soft toilet paper, 12 mega rolls | 429/12 | 320/12 | $9.97 | $8.44 | $0.19 | $0.22 | 13.5% | -25.4% |

| Angel Soft toilet paper, 18 mega rolls | 429/18 | 320/18 | $14.97 | $13.12 | $0.19 | $0.23 | 17.5% | -24.7% |

| Bounty Select-A-Size paper towels, 8 triple rolls | 165/8 | 135/8 | $19.88 | $22.18 | $1.51 | $2.05 | 36.4% | -18.2% |

| Quilted Northern Ultra Plush toilet paper, 18 mega rolls | 308/18 | 255/18 | $17.43 | $18.68 | $0.31 | $0.41 | 29.1% | -17.2% |

| Charmin Ultra Strong toilet paper, 24 mega rolls | 286/24 | 242/24 | $23.82 | $26.48 | $0.35 | $0.46 | 31.4% | -15.4% |

| Great Value Ultra Strong toilet paper, 12 mega rolls | 286/12 | 242/12 | $10.73 | $12.48 | $0.31 | $0.43 | 37.5% | -15.4% |

| Charmin Ultra Soft toilet paper, 12 mega rolls | 284/12 | 244/12 | $12.97 | $14.97 | $0.38 | $0.51 | 34.3% | -14.1% |

| Cottonelle Ultra Comfort toilet paper, 12 mega rolls | 284/12 | 244/12 | $12.48 | $12.98 | $0.37 | $0.44 | 21.1% | -14.1% |

| Sparkle Pick-A-Size paper towels, 8 double rolls | 126/8 | 110/8 | $8.22 | $13.19 | $0.82 | $1.50 | 83.8% | -12.7% |

| Scott Choose-A-Sheet paper towels, 6 double rolls | 110/6 | 100/6 | $5.98 | $6.84 | $0.91 | $1.14 | 25.8% | -9.1% |

| Great Value Ultra Strong paper towels, 6 double rolls | 120/6 | 110/6 | $8.42 | $8.97 | $1.17 | $1.36 | 16.2% | -8.3% |

| Sparkle Pick-A-Size paper towels, 6 double rolls | 120/6 | 110/6 | $6.44 | $7.28 | $0.89 | $1.10 | 23.3% | -8.3% |

| Scott 1000 toilet paper, 12 rolls | 1,000/12 | 1,000/12 | $9.78 | $11.84 | $0.08 | $0.10 | 21.1% | 0.0% |

| Scott 1000 toilet paper, 20 rolls | 1,000/20 | 1,000/20 | $13.98 | $17.83 | $0.07 | $0.09 | 27.5% | 0.0% |

| Scott 1000 toilet paper, 30 rolls | 1,000/30 | 1,000/30 | $21.38 | $39.27 | $0.07 | $0.13 | 83.7% | 0.0% |

| Seventh Generation white bathroom tissue, 24 count | 240/24 | 240/24 | $16.99 | $20.47 | $0.29 | $0.36 | 20.5% | 0.0% |

| Bounty Select-A-Size paper towels, 6 triple rolls | 165/6 | 165/6 | $14.97 | $20.99 | $1.51 | $2.12 | 40.2% | 0.0% |

| Seventh Generation recycled paper towels, 6 count | 140/6 | 140/6 | $14.28 | $22.65 | $1.70 | $2.70 | 58.6% | 0.0% |

| Scott multipurpose shop towels, 2 rolls | 55/2 | 55/2 | $4.71 | $4.67 | $4.28 | $4.25 | -0.8% | 0.0% |

| Cottonelle Ultra ComfortCare toilet paper, 18 mega rolls | 284/18 | 312/18 | $16.48 | $22.50 | $0.32 | $0.40 | 24.3% | 9.9% |

Breakfast, candy and snacks: Which products shrunk the most

After household paper products, breakfast items were the most likely to shrink. Of the 16 cereals analyzed, seven (or 43.8%) downsized between 2019 or 2020 and 2024.

Of these, family-size Frosted Flakes shrank the most (9.6%) per ounce from 24.0 ounces to 21.7. Next, family-size Raisin Bran dropped 7.9% from 24.0 ounces to 22.1. Finally, family-size cinnamon oat crunch Cheerios decreased by 7.7% from 26 ounces to 24.

As for price hikes, Raisin Bran saw the biggest increase in price per ounce. With prices increasing from 15 cents per ounce to 23 cents, consumers are paying 53.3% more per ounce. Cinnamon oat crunch Cheerios and Great Value old fashioned oats experienced the next biggest price hikes, both at 50.0% per ounce.

Looking at candy, five of the 13 (38.5%) items analyzed changed size. Party-size Reese’s miniatures and party-pack Rolo chewy caramels decreased the most, both at 11.0% from 40.0 ounces to 35.6.

Party-size Reese’s miniatures, party-pack Rolos and party-pack Hershey’s miniature assortments tied for the largest price increases, all jumping 68.2% per ounce. Party-size dark chocolate M&M’s were just behind at an increase of 68.0% per ounce.

Turning to snacks, six of 22 (27.3%) products analyzed shrunk. A 36-count of FunPops freeze pops downsized by 20.0% from 90 ounces to 72. Meanwhile, a party-sized bag of Lay’s sour cream and onion potato chips shrunk by 15.3% from 14.75 ounces to 12.50 and a party-size bag of Cheetos decreased by 14.3% from 17.5 ounces to 15.0.

Those party-size Cheetos saw the biggest price increase. While the size shrunk from 17.5 ounces to 15.0 ounces, prices jumped from 17 cents an ounce to 40 cents — a whopping price increase of 135.3% per ounce. Next, family-size Oreos saw a price increase of 110.5% per ounce and family-size original Wheat Thins saw a price increase of 89.5% per ounce.

The last 27 products we analyzed were combined under “other” — only two of which saw size decreases (with a caveat for one). For more information, see the relevant table below.

Full rankings: Breakfast products that shrunk the most/least

| Product | Old size (ounces) | New size (ounces) | Old cost | New cost | Old price per ounce | New price per ounce | Price difference per ounce (%) | Size change |

|---|---|---|---|---|---|---|---|---|

| Family-size Frosted Flakes | 24.0 | 21.7 | $3.64 | $4.48 | $0.15 | $0.21 | 40.0% | -9.6% |

| Family-size Raisin Bran | 24.0 | 22.1 | $3.64 | $4.98 | $0.15 | $0.23 | 53.3% | -7.9% |

| Family-size cinnamon oat crunch Cheerios | 26 | 24 | $3.64 | $4.93 | $0.14 | $0.21 | 50.0% | -7.7% |

| Family-size Cocoa Puffs | 19.3 | 18.1 | $3.64 | $4.93 | $0.19 | $0.27 | 42.1% | -6.2% |

| Family-size apple cinnamon Cheerios | 20.1 | 19.0 | $3.64 | $4.93 | $0.18 | $0.26 | 44.4% | -5.5% |

| Family-size Reese’s Puffs | 20.7 | 19.7 | $3.64 | $4.93 | $0.18 | $0.25 | 38.9% | -4.8% |

| Honey Nut Chex | 20.3 | 19.6 | $3.43 | $4.93 | $0.17 | $0.25 | 47.1% | -3.4% |

| Great Value old fashioned oats | 42 | 42 | $2.46 | $3.98 | $0.06 | $0.09 | 50.0% | 0.0% |

| Quaker Oats quick 1-minute oats | 42 | 42 | $3.88 | $5.12 | $0.09 | $0.12 | 33.3% | 0.0% |

| Nutella hazelnut spread | 33.5 | 33.5 | $7.97 | $9.87 | $0.24 | $0.29 | 20.8% | 0.0% |

| Family-size Special K red berries | 16.9 | 16.9 | $3.88 | $4.98 | $0.23 | $0.31 | 26.1% | 0.0% |

| Family-size Cheerios | 18 | 18 | $3.53 | $4.44 | $0.20 | $0.25 | 25.0% | 0.0% |

| Family-size Kix | 18 | 18 | $3.98 | $4.93 | $0.22 | $0.27 | 22.7% | 0.0% |

| Family-size Corn Pops | 19.1 | 19.1 | $3.64 | $4.48 | $0.19 | $0.23 | 21.1% | 0.0% |

| Fruity Pebbles cereal bag | 36 | 36 | $5.98 | $6.48 | $0.17 | $0.18 | 5.9% | 0.0% |

| Hungry Jack buttermilk pancake and waffle mix, 6 pack | 196 | 196 | $16.65 | $16.62 | $0.08 | $0.08 | 0.0% | 0.0% |

Full rankings: Candy products that shrunk the most/least

| Product | Old size (ounces) | New size (ounces) | Old cost | New cost | Old price per ounce | New price per ounce | Price difference per ounce (%) | Size change |

|---|---|---|---|---|---|---|---|---|

| Party-size Reese’s miniatures | 40.0 | 35.6 | $8.98 | $13.24 | $0.22 | $0.37 | 68.2% | -11.0% |

| Party-pack Rolo chewy caramels | 40.0 | 35.6 | $8.98 | $13.24 | $0.22 | $0.37 | 68.2% | -11.0% |

| Party-pack Hershey’s miniatures assortment | 40.0 | 35.9 | $8.98 | $13.24 | $0.22 | $0.37 | 68.2% | -10.3% |

| Party-size milk chocolate M&M’s | 42 | 38 | $8.98 | $12.96 | $0.21 | $0.34 | 61.9% | -9.5% |

| Party-size dark chocolate M&M’s | 19.2 | 18.0 | $4.86 | $7.48 | $0.25 | $0.42 | 68.0% | -6.3% |

| Snickers, Twix, 3 Musketeers, Milky Way variety pack, 18 full-size bars | 33.31 | 33.31 | $11.84 | $19.98 | $0.36 | $0.60 | 66.7% | 0.0% |

| Hershey’s, KitKats, Reese’s variety pack, 18 full-size bars | 27.3 | 27.3 | $11.84 | $19.12 | $0.43 | $0.70 | 62.8% | 0.0% |

| Party-size milk chocolate Kisses | 35.8 | 35.8 | $8.98 | $13.24 | $0.25 | $0.37 | 48.0% | 0.0% |

| Party-pack York Peppermint Patties | 35.2 | 35.2 | $8.98 | $13.24 | $0.26 | $0.38 | 46.2% | 0.0% |

| Party-size peanut M&M’s | 38 | 38 | $8.98 | $12.96 | $0.24 | $0.34 | 41.7% | 0.0% |

| Party-size Haribo Goldbears gummi candies | 48 | 48 | $7.98 | $10.48 | $0.17 | $0.22 | 29.4% | 0.0% |

| Fruit Adventure Tic Tacs | 3.4 | 3.4 | $3.24 | $3.98 | $0.95 | $1.17 | 23.2% | 0.0% |

| Brookside acai and blueberry dark chocolate | 21 | 21 | $9.15 | $10.17 | $0.44 | $0.48 | 9.1% | 0.0% |

Full rankings: Snack products that shrunk the most/least

| Product | Old size (ounces) | New size (ounces) | Old cost | New cost | Old price per ounce | New price per ounce | Price difference per ounce (%) | Size change |

|---|---|---|---|---|---|---|---|---|

| FunPops freeze pops, 36 count | 90 | 72 | $2.68 | $2.98 | $0.03 | $0.04 | 33.3% | -20.0% |

| Party-size sour cream and onion Lay’s | 14.75 | 12.50 | $3.98 | $5.44 | $0.27 | $0.44 | 63.0% | -15.3% |

| Party-size Cheetos | 17.5 | 15.0 | $2.94 | $5.94 | $0.17 | $0.40 | 135.3% | -14.3% |

| Family-size original Wheat Thins | 16 | 14 | $2.98 | $4.98 | $0.19 | $0.36 | 89.5% | -12.5% |

| Party-size original Tostitos | 18 | 17 | $3.48 | $5.94 | $0.19 | $0.35 | 84.2% | -5.6% |

| Party-size nacho cheese Doritos | 15.0 | 14.5 | $3.48 | $5.94 | $0.23 | $0.41 | 78.3% | -3.3% |

| Family-size Oreos | 19.1 | 19.1 | $3.56 | $7.59 | $0.19 | $0.40 | 110.5% | 0.0% |

| Family-size Honey Maid crackers | 25.6 | 25.6 | $4.48 | $8.55 | $0.18 | $0.33 | 83.3% | 0.0% |

| Family-size Triscuit original crackers | 12.5 | 12.5 | $2.98 | $4.98 | $0.24 | $0.40 | 66.7% | 0.0% |

| Welch’s mixed fruit snacks, 40 count | 36 | 36 | $6.98 | $11.00 | $0.19 | $0.31 | 63.2% | 0.0% |

| Party-size Stacy’s Simply Naked pita chips | 18 | 18 | $5.84 | $8.99 | $0.32 | $0.50 | 56.3% | 0.0% |

| Party-size Tostitos Scoops | 14.5 | 14.5 | $3.98 | $5.94 | $0.27 | $0.41 | 51.9% | 0.0% |

| SkinnyPop skinny pack, 6 bags | 3.9 | 3.9 | $4.98 | $7.37 | $1.28 | $1.89 | 47.7% | 0.0% |

| Family-size Nutter Butter cookies | 16 | 16 | $3.56 | $4.88 | $0.22 | $0.31 | 40.9% | 0.0% |

| Ritz 12 fresh stack sleeves | 17.8 | 17.8 | $3.56 | $4.98 | $0.20 | $0.28 | 40.0% | 0.0% |

| Family-size Chips Ahoy! original chocolate chip cookies | 18.2 | 18.2 | $3.53 | $4.78 | $0.19 | $0.26 | 36.8% | 0.0% |

| Annie’s Berry Patch bunny fruit snacks | 16 | 16 | $9.88 | $12.80 | $0.62 | $0.80 | 29.0% | 0.0% |

| Sensible Portions sea salt garden veggie straws | 14 | 14 | $4.48 | $5.47 | $0.32 | $0.39 | 21.9% | 0.0% |

| Goldfish cheddar crackers | 30 | 30 | $7.48 | $8.88 | $0.25 | $0.30 | 20.0% | 0.0% |

| Great Value granola bars | 20.3 | 20.3 | $3.17 | $3.84 | $0.16 | $0.19 | 18.8% | 0.0% |

| Family-size Cheez-Its | 21 | 21 | $4.54 | $5.18 | $0.22 | $0.25 | 13.6% | 0.0% |

| Original Rice Krispies Treats | 31.2 | 31.2 | $8.98 | $9.88 | $0.29 | $0.32 | 10.3% | 0.0% |

Full rankings: Other products that shrunk the most/least

| Product | Old size (ounces) | New size (ounces) | Old cost | New cost | Old price per ounce | New price per ounce | Price difference per ounce (%) | Size change |

|---|---|---|---|---|---|---|---|---|

| Bear Creek cheddar broccoli soup mix | 22.4 | 10.6 | $6.88 | $3.86 | $0.31 | $0.36 | 16.1% | -52.7% |

| Folgers classic roast ground coffee | 48.0 | 40.3 | $9.96 | $14.87 | $0.21 | $0.37 | 76.2% | -16.0% |

| Knorr cheddar broccoli pasta sides | 12.9 | 12.9 | $2.86 | $8.47 | $0.22 | $0.66 | 200.0% | 0.0% |

| Jiffy corn muffin mix, 6 boxes | 51 | 51 | $6.74 | $14.75 | $0.13 | $0.29 | 123.1% | 0.0% |

| Great Value extra virgin olive oil | 25.5 | 25.5 | $5.47 | $10.88 | $0.21 | $0.43 | 104.8% | 0.0% |

| Barilla penne pasta | 96 | 96 | $7.10 | $11.04 | $0.07 | $0.12 | 71.4% | 0.0% |

| Value-size Heinz tomato ketchup | 64 | 64 | $4.22 | $7.36 | $0.07 | $0.12 | 71.4% | 0.0% |

| Hormel chili with beans, 4 pack | 60 | 60 | $6.68 | $10.80 | $0.11 | $0.18 | 63.6% | 0.0% |

| Armour original Vienna Sausage, 12 pack | 55.2 | 55.2 | $5.52 | $8.76 | $0.10 | $0.16 | 60.0% | 0.0% |

| Maxwell House breakfast blend ground coffee | 25.6 | 25.6 | $6.34 | $9.98 | $0.25 | $0.39 | 56.0% | 0.0% |

| Great Value ground black pepper | 6 | 6 | $3.98 | $5.72 | $0.66 | $0.95 | 43.9% | 0.0% |

| Value-size Hidden Valley ranch salad dressing | 36 | 36 | $5.48 | $6.98 | $0.15 | $0.19 | 26.7% | 0.0% |

| Gatorade 18-count variety pack | 216 | 216 | $8.96 | $10.98 | $0.04 | $0.05 | 25.0% | 0.0% |

| Great Value honey | 12 | 12 | $2.98 | $3.74 | $0.25 | $0.31 | 24.0% | 0.0% |

| Jif creamy peanut butter | 40 | 40 | $5.44 | $6.97 | $0.14 | $0.17 | 21.4% | 0.0% |

| Spam classic, 2 pack | 24 | 24 | $6.28 | $7.48 | $0.26 | $0.31 | 19.2% | 0.0% |

| StarKist chunk light tuna in water, 8 packs | 40 | 40 | $6.92 | $7.98 | $0.17 | $0.20 | 17.6% | 0.0% |

| Velveeta original shells and cheese, 3 pack | 36 | 36 | $6.48 | $7.47 | $0.18 | $0.21 | 16.7% | 0.0% |

| StarKist solid white albacore tuna | 12 | 12 | $3.28 | $3.72 | $0.27 | $0.31 | 14.8% | 0.0% |

| Value-size Prego Italian sauce flavored with meat | 67 | 67 | $4.37 | $5.36 | $0.07 | $0.08 | 14.3% | 0.0% |

| Great Value chunk chicken breast, 4 pack | 50 | 50 | $7.48 | $8.72 | $0.15 | $0.17 | 13.3% | 0.0% |

| Rao’s homemade marinara sauce | 24 | 24 | $6.24 | $6.88 | $0.26 | $0.29 | 11.5% | 0.0% |

| King Arthur gluten-free all-purpose biscuit and baking mix | 24 | 24 | $5.24 | $5.82 | $0.22 | $0.24 | 9.1% | 0.0% |

| Kraft original mac and cheese, 5 pack | 36.25 | 36.25 | $4.53 | $4.88 | $0.12 | $0.13 | 8.3% | 0.0% |

| Horizon organic low-fat milk, 12 boxes | 96 | 96 | $11.94 | $12.53 | $0.12 | $0.13 | 8.3% | 0.0% |

| Hunt’s traditional pasta sauce | 24 | 24 | $1.48 | $1.34 | $0.06 | $0.06 | 0.0% | 0.0% |

| Chef Boyardee rice with chicken and vegetables | 7.25 | 7.25 | $1.48 | $1.18 | $0.20 | $0.16 | -20.0% | 0.0% |

Majority of Americans have noticed or experienced shrinkflation

Given how many products have shrunk, it may not be surprising that 71% of Americans report experiencing or noticing at least one incident of shrinkflation in the past year. And 57% have experienced or noticed multiple incidents.

By generation, baby boomers (ages 60 to 78) are the most likely to have experienced or noticed shrinkflation multiple times in the past year, at 70%. That compares with 48% of Gen Zers (ages 18 to 27) and 54% of millennials (ages 28 to 43). Six-figure earners (68%) are the most likely income group to notice shrinkflation multiple times, while those earning less than $30,000 (47%) are the least likely.

Of those who’ve noticed or experienced shrinkflation at least once, 87% agree it’s becoming more common. That’s especially true among six-figure earners (93%) and baby boomers (92%).

Schulz says businesses prefer shrinking products over raising prices.

“Businesses know that customers don’t like when prices go up,” he says. “Shrinkflation is a sneaky little way around that. Rather than bumping up the price of something, businesses make the product smaller while keeping the price the same. If done smartly, customers may not even notice. However, the problem is that when they do, it leaves the customer with a bad taste in their mouth because it feels so deceptive.”

While our study found household products shrunk the most, consumers tend to notice shrinkflation in food and beverages more than anything else. Of those who’ve noticed shrinkflation, 87% caught it with food and beverages. That’s followed by products in the following categories:

- Personal care (48%)

- Household cleaning (43%)

- Paper goods (37%)

- Pet food (36%)

- Health and wellness (31%)

Many consumers stop buying products when they feel deceived

Understandably, consumers aren’t happy with shrinkflation — and they’re willing to do something about it. Of those who’ve noticed shrinkflation, 82% say they have felt deceived by it. What’s more, 66% have stopped buying products because of it.

Gen Zers are most likely to boycott a product due to shrinkflation, at 80%. Millennials (73%) are the next closest generation to do so.

Regardless of whether they’ve noticed shrinkflation, 69% of consumers say they’d be less likely to purchase a product they normally buy if it shrank while maintaining its price.

Across all Americans, 90% believe companies should clearly label when they reduce the size or quantity of a product, with 66% believing it should be mandatory regardless of the changes made.

Americans would prefer companies raise prices

Prices aren’t the only thing that matters to consumers, which may be why so many notice shrinkflation. Across all Americans, 89% always or sometimes compare brands’ product sizes when shopping.

If they had to choose between the “shrink” and the “‘flation,” Americans would prefer that companies raise prices, at 38% versus 28%.

Six-figure earners (54%) and those with children younger than 18 (46%) are the most likely to prefer price hikes. Meanwhile, Gen Zers (37%) and those earning less than $30,000 (31%) are the most likely to prefer companies to shrink products.

Why don’t companies raise prices instead of shrinking products? Schulz says it boils down to what companies think they can get away with.

“Businesses know that customers aren’t always super diligent in comparison shopping, so shrinking the product a little bit is likely to go completely unnoticed by many people,” he says. “Companies know full well that it’ll turn some customers off, too. The calculation they have to make is to weigh the risk of shrinkflation versus the risk of hiking prices. It’s quite clear that many companies prefer the former.”

Handling shrinking products without shrinking wallets: Top expert tips

Shrinkflation affects everyone. If you have little room in your grocery budget, those smaller products may have major implications for you. But there are ways to work around it. Schulz recommends the following:

- Don’t be too brand loyal. “We all love certain companies, but loyalty can do more harm than good to our wallets when money’s tight,” he says. “Don’t be afraid to comparison shop products from other companies if you suspect your favorite is engaging in shrinkflation.”

- Let credit card rewards help. “Rewards won’t keep your prices down, but they can make sure you get a little bit back when you buy,” he says. “If you know that you spend a large portion of your monthly budget on groceries each month, consider applying for a grocery rewards credit card to bump up your earnings even more.”

- Consider buying in bulk. According to a LendingTree study on bulk buying, consumers could save 27% on average by buying in larger quantities. Not only can that save you trips to the grocery store, but it can also help extend your budget a little further.

Methodology

To analyze whether manufacturers are reducing package sizes, LendingTree researchers collected information on 98 products from the following categories:

- Household paper products

- Breakfast

- Candy

- Snacks

- Other

Researchers compared Walmart prices and product sizes from 2019 and 2020 to 2024. Current prices were collected from Walmart’s website in August and September 2024. The historical data was obtained using the Wayback Machine, which captures past versions of websites.

Additionally, LendingTree commissioned QuestionPro to conduct an online survey of 2,040 U.S. consumers ages 18 to 78 from Sept. 3 to 5, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78